Feel GOOD about your FUTURE…

A 5 minute read

Feel good about your future

Our step-by-step guide will help you create a clear and easy path to retirement, so that you can rest assured you’ll have the future you want…

1) Work out how much you’ll need when you retire

What do you want to do when you retire and when do you want to retire?

You may not want to stop working until later, or work part-time - everyone is different but in order to work out how much you need to save, you need to have a good idea of how much you’ll need to achieve the lifestyle you want.

Think about how much money you will need each year for the essentials, like bills, food, clothing, mortgage or rent, etc and then think about the extra money you will need for luxuries, such as holidays, eating out, treating yourself – all the things you want to have enough money to do.

Tip: According to the UK Retirement Living Standards – for a minimum lifestyle, you need to be aiming to have at least £10,200 per year for a single person and £15,700 for a couple. For a moderate lifestyle, you want to aim for at least £20,200 a year for singles and £29,100 for couples, and for a comfortable retirement, you should aim to have £33,000 a year for a single person and £47,500 for a couple.

2) Take a closer look at your workplace pension

Get to know your workplace pension - check how much you currently have saved, and look at how much you are paying in and how much the company is paying in.

All of this information can be found on your annual benefit statement - which your employer should send to you every year.

Your statement will also tell you what the total amount you have saved is likely to equate to in retirement, if you carry on putting the same amount away. You need to ask yourself: ‘Is this going to be enough to give me the lifestyle I want?’ If it is, then you’re on the right track.

If you think you need to save more, then look at ways you could make any savings on your outgoings to contribute. The steps below will help with this.

Make sure you maximise your employer contribution. Many companies will match your contribution or pay higher contributions and you also get tax relief from the Government - this is FREE MONEY, so make sure you take full advantage of this.

Tip: Saving half your age is a good rule of thumb to work with, so if you start saving at age 30, you'll need to save 15% of your salary into your pension and maintaining this amount until retirement.

3) Check your State pension

A State Pension is paid to you by the Government - as long as you’ve made enough qualifying national insurance contributions. The full new amount is currently £179.60 a week and to get this you’ll need a total of 35 qualifying years of National Insurance contributions or credits. You’ll usually need at least 10 qualifying years on your National Insurance record to get ANY State Pension.

When you’ll get your State Pension depends on when you were born, so it’s worth checking when you’re likely to get yours on the Government’s website:

gov.uk/calculate-state-pension

Tip: If you are not getting the full amount or are not on track for it, you can top-up your State Pension if you want to. For more information on this visit:

gov.uk/check-state-pension

4) Track down all of your old pensions from previous jobs

Yes, it may take a bit of time, but it’ll be worth it if you find pots of money! Go through any old piles of paperwork to see if you can find details of any old pension schemes. If you can find this information, email or call the company providing the pension, and ask them for more information about your savings.

If you're trying to track down a workplace pension, you could also try contacting the company you used to work for.

If you can’t find any of these details – The Government offers a free pension tracing service to help you track down any missing pension pots. You can visit their website:

gov.uk/find-lost-pension

Tip: It is possible (depending on the scheme) to combine all of your different pension pots to make them more manageable. To do this, you need to check that you can move them and make sure that you won’t lose out on any benefits, guarantees or special features by doing so.

5) Review your other savings

Have you got any other savings, or other assets that could supplement your retirement?

For example, another property, or an inheritance, or do you have other savings, such as an ISA or other investments. Make sure you factor these into your retirement planning.

6) Calculate your overall retirement savings

With all the information that you’ve gathered from the above steps, you should be able to calculate an overall figure and assess whether that’s likely to be enough to give you the lifestyle you want in the future.

If the figure isn't as high as you thought it might be or isn't enough to meet your aspirations – don’t worry, there's still time to take action and it's never too late to start saving more.

7) Think about paying more into your pension

If you are feeling like you don't have enough saved - don't panic. The hardest step is knowing what you need to do and making a plan.

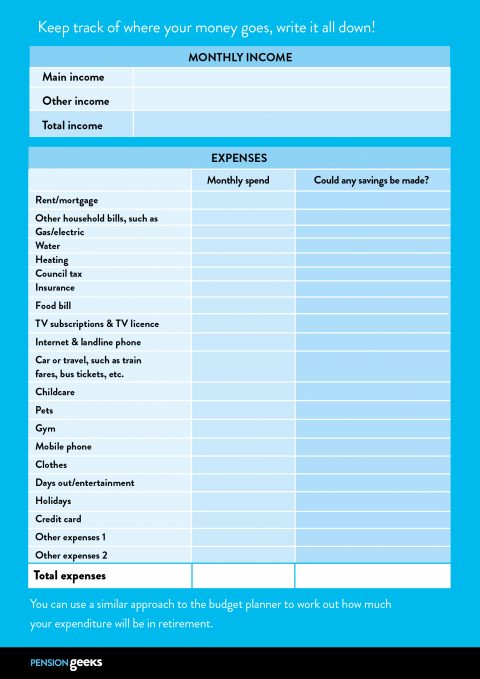

Could you afford to boost your pension pot further and pay more in? Our helpful budget planner could help you work out if you can make any potential savings on any of you outgoings that you could potentially put into your pension.

If you get any bonuses or pay rises, could you pay part or all of these into your pot?

Your pension is invested, so find out where your funds are held and whether this is right for your individual circumstances.

Tip: By just increasing your contribution by 1% can help you achieve a lot more for your future. See your annual benefit statement to see how much of a difference adding just 1% can make.

8) Free guidance:

There are plenty of free services at your disposal that have been set up by the Government to offer help with money and pensions topics - make sure you make full use of them:

MoneyHelper - offers helpful information on pensions and other money topics, such as debt, borrowing, work and benefits, budgeting and saving – to name but a few.

Pension Wise - is a free and impartial guidance service to help you understand the different ways you can take your pension money. You have to be aged 50 or over to be able to use the service.

If you want to find an independent financial adviser near you, The Financial Conduct Authority is a good place to start: fca.org.uk

Keep track of where your money goes, write it all down with our helpful budget planner. You can download this in the useful stuff section:

The information contained within this article is to serve as a guide and does not constitute financial advice in any way.

The information presented is, to the best of our knowledge, correct at time of publication. September 2021.